What Is Depreciation, and How Does it Work?

Tara Corporation, a calendar year taxpayer, was incorporated on March 15. For purposes of the half-year convention, it has a short tax year of 10 months, ending on December 31, 2023. During the short tax year, Tara placed property in service for which it uses the half-year convention.

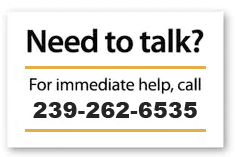

Small Business Resources

This chapter explains how to determine which MACRS depreciation system applies to your property. It also discusses other information you need to know before you can figure depreciation under MACRS. This http://tolstoy-lit.ru/words/0-DONE/tolstoy/done.htm information includes the property’s recovery class, placed in service date, and basis, as well as the applicable recovery period, convention, and depreciation method. It explains how to use this information to figure your depreciation deduction and how to use a general asset account to depreciate a group of properties.

- Sandra and Frank must adjust the property’s basis for the casualty loss, so they can no longer use the percentage tables.

- Use the Depreciation Worksheet for Passenger Automobiles in chapter 5..

- Your depreciation deduction for the year cannot be more than the part of your adjusted basis in the stock of the corporation that is allocable to your business or income-producing property.

- You also generally continue to use the longer recovery period and less accelerated depreciation method of the acquired property.

- (Based on the half-year convention, you used only half a year of the recovery period in the first year.) You multiply the reduced adjusted basis ($800) by the result (22.22%).

What Are Depreciable Business Assets?

Suppose that the company is using the straight-line schedule originally described. After three years, the company changes the expected useful life to a total of 15 years but keeps the salvage value the same. With a book value of $73,000 at this point (one does not go back and “correct” the depreciation applied so far when changing assumptions), there is $63,000 left to depreciate. This will be done over the next 12 years (15-year lifetime minus three years already). If you look at the long-term assets, such as property, plant, and equipment (PP&E), on a balance sheet, there http://www.moviesubtitles.org/movies-s.html are often two lines showing the cost value of those assets and how much depreciation has been charged against that value. Sometimes, these are combined into a single line such as “PP&E net of depreciation.”

- However, it pays you for any costs you incur in traveling to the various sites.

- There are also special rules and limits for depreciation of listed property, including automobiles.

- Passenger automobiles; any other property used for transportation; and property of a type generally used for entertainment, recreation, or amusement.

- The following discussions provide information about the types of qualified property listed above for which you can take the special depreciation allowance.

What property is depreciable?

Therefore, Silver Leaf’s qualifying cost for the section 179 deduction is $520. Even if the requirements explained earlier under What Property Qualifies? Are met, you cannot elect the section 179 deduction for the following property. Certain property does not qualify for the section 179 deduction.

Understanding Methods and Assumptions of Depreciation

For the inclusion amount rules for a leased passenger automobile, see Leasing a Car in chapter 4 of Pub. You are considered regularly engaged in the business of leasing listed property only if you enter into contracts for the leasing of listed property with some frequency over a continuous period of time. This determination http://sadovnikinfo.ru/ogorod/1347-trikhozanat-yaponskiy-zmeevidnyy-ogurets-vyrashchivaem-doma.html is made on the basis of the facts and circumstances in each case and takes into account the nature of your business in its entirety. For example, if you lease only one passenger automobile during a tax year, you are not regularly engaged in the business of leasing automobiles. An employer who allows an employee to use the employer’s property for personal purposes and charges the employee for the use is not regularly engaged in the business of leasing the property used by the employee.

Leave a Reply